Standard and Poor’s credit upgrade, executive remuneration, Victorian Liberal Party, election speculation, Budget, Iraq

February 17, 2003Trans-Tasman Tax Break-Through

February 19, 2003NO.005

AAA AGAIN FOR AUSTRALIA

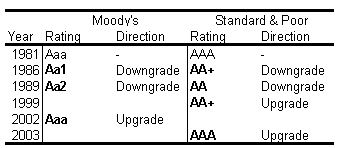

Australia’s AAA credit rating has been restored today by the international credit ratings agency, Standard and Poor’s, finally closing the chapter on Paul Keating’s infamous `Banana Republic’. Australia’s foreign currency credit rating was downgraded in 1986 and 1989, under the previous Labor Government. It has now been returned to the AAA level.

Today’s announcement means that both of the major ratings agencies have restored Australia’s foreign currency credit rating to the highest possible level. Moody’s upgraded Australia to Aaa late last year, a rating that was downgraded in 1986 and further in 1989.

S&P attributed today’s upgrade to the Government’s strong fiscal position and to the good financial standing and sophisticated risk management practices of the private sector.

Referring to Australia’s public finances, S&P said that “Australia has one of the strongest fiscal positions, including `AAA’ rated sovereigns” and that “net general government debt to GDP is projected to fall to 3 per cent at year-end 2003 from 20 per cent seven years before.”

And with respect to the private sector, S&P says that Australia’s reliance on foreign savings is “mitigated in S&P’s view by the high credit standing of Australia’s major banks, by the depth of the foreign exchange and derivatives markets for Australian dollars, and by substantial claims on non-residents by the Australian private sector from hedging activities, which are not captured in a traditional International Investment Position presentation.”

Today’s upgrade applies to Australia’s foreign currency borrowings. The Commonwealth domestic currency borrowings have always been rated AAA.

The ratings upgrade places Australia with sixteen other countries on the AAA rating: Austria, Canada, Denmark, Finland, France, Germany, Ireland, the Isle of Man, Liechtenstein, Luxembourg, the Netherlands, Norway, Singapore, Switzerland, the United Kingdom, and the United States.

While the Commonwealth has not borrowed in net terms since 1997, the benefits of today’s ratings upgrade will be realised by Australia’s private sector companies which will be able to borrow more cheaply in foreign markets. This will help underpin growth and help create job opportunities.

Contact: Niki Savva

02 6277 7340